All Categories

Featured

Table of Contents

"Recognizing the Tax Obligation Foreclosure Process" supplies a thorough summary of Tax obligation Title Revenue and Repossession procedures in material that accompanied a 2005 seminar. Minimal Assistance Representation (LAR) is readily available to any event that feels he or she can not manage or does not want a lawyer for the entire case, yet might use some help on a minimal basis.

An investor that obtains a tax obligation lien certificate collects a lawful claim versus the residential property for the amount paid. A tax obligation lien can be positioned on a residential property because the owner hasn't paid property taxes.

The lien is removed when the proprietor pays the tax obligations however the metropolitan or region authority will eventually auction the lien off to an investor if they remain to go unsettled. A certificate is issued to the capitalist outlining the impressive tax obligations and charges on the property after they've put a winning bid.

Tax Liens Investing Reddit

Not all states, counties, or municipalities supply tax obligation liens. Some states such as The golden state only hold tax obligation sales on defaulted properties, causing the winning bidder ending up being the legal proprietor of the residential property in question. The term of tax lien certifications typically varies from one to 3 years. The certification enables the capitalist to accumulate the overdue tax obligations plus the applicable prevailing rate of passion during this time.

Tax lien certifications can be bid on and won based upon the highest money amount, the most affordable rate of interest, or one more method - us tax liens investing. The sale of a tax lien certification starts when the local federal government sends out tax obligation costs to residential property proprietors for the amount owed on their home taxes. The regional federal government places a tax obligation lien on the property if the homeowner falls short to pay the tax obligations in a timely manner

Prospective buyers typically need to register and supply a down payment prior to taking part. Financiers bid on the tax obligation lien certifications at the auction by using to pay the unpaid tax obligations plus any rate of interest and costs. The winning prospective buyer receives a certificate that stands for a lien on the building for the quantity they paid.

The investor is usually able to seize on the building and take ownership if the proprietor stops working to redeem the certification. A building has to be taken into consideration tax-defaulted for a minimum period that depends on regional law prior to it's subject to the lien and auction process.

A financier can potentially acquire the residential property for dimes on the buck if the homeowner falls short to pay the back taxes. Obtaining a property in this fashion is a rare incident, nonetheless, since the majority of tax obligation liens are redeemed well before the residential property goes to repossession. The rate of return on tax lien certificates isn't assured and can differ depending on whether the residential property proprietor redeems the certificate and whether the capitalist can seize on the residential property.

Unfavorable facets of tax obligation lien certificates include the need that the capitalist pay the tax obligation lien certification quantity completely within a really short period, typically one to 3 days. These certificates are likewise very illiquid because there's no additional trading market for them. Those that buy tax lien certificates must additionally take on significant due diligence and research to guarantee that the underlying residential or commercial properties have actually a proper evaluated value.

Secrets Of Tax Lien Investing

There may be taxes enforced at the government, state, or local degrees depending on the circumstances of the certificate. The income made may be subject to tax obligations if a financier gains rate of interest on a tax obligation lien certification. Interest income is usually reported on the financier's income tax return in the year it's earned.

The capitalist will certainly obtain the amount paid for the certificate plus the passion gained if the residential or commercial property owner redeems the tax lien certification by paying the unpaid tax obligations and any type of interest or costs owed. The investor can take ownership of the property via foreclosure if the home proprietor is not able to retrieve the tax obligation lien certificate.

Any earnings or gains gained from the sale or service of the residential or commercial property will certainly additionally be tired, just as with any type of other home. Some states and localities may likewise impose taxes or fees on tax obligation lien certificate financial investments.

Residential property owners deserve to redeem a tax lien by paying the unsettled tax obligations plus any kind of rate of interest or fees owed. Home loan liens can generally only be pleased by repaying the whole underlying financing. Both liens are similar in that they represent debt that might be paid off however the hidden nature of that debt is various.

A local government entity may wish to offer the lien to a capitalist through a tax lien certification sale afterwards time has actually passed. Mortgage liens can last for the period of the mortgage which might be dramatically longer. Property tax obligation lien investing might be a probable financial investment for those that want to hold different investments and desire exposure to real estate.

Invest In Tax Lien Certificates

It's normally encouraged that you comprehend tax lien investing, recognize the neighborhood property market, and study on residential or commercial properties prior to investing. There are numerous drawbacks to tax obligation lien investing. It can be easy to overbid on tax lien properties or otherwise fully comprehend the redemption periods. You might hold a minimal insurance claim to other, more highly refined liens on the residential or commercial property.

Having a tax lien against you does not always hurt your debt because the three significant credit scores bureaus do not consist of tax liens on their non-mortgage consumer debt reports. Building tax obligation liens may be a matter of public document and the info that you owe an impressive tax bill would be widely offered to the general public.

A city government develops a lien versus the building and can auction off the rights to that lien in the form of a certificate if the taxes continue to go unpaid. An investor that purchases the tax obligation lien certificate may be able to recover their principal while additionally making some interest through fine fees must the original residential or commercial property proprietor be able to repay the tax obligation lien in the future.

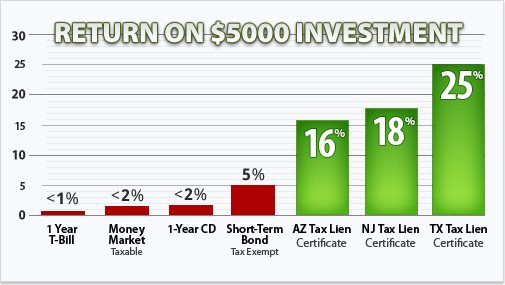

The trick to is to allow your cash to help you. Tax liens are an effective means to do this. In Arizona, a person may buy tax liens and obtain approximately 16% on their financial investment if they are retrieved. If they are not redeemed, the financier might foreclose upon the home after 3 (and up to ten years). The procedure is fairly simple.

Table of Contents

Latest Posts

Surplus Money

Tax Lien On Foreclosed Property

Tax Foreclosure Property Auction

More

Latest Posts

Surplus Money

Tax Lien On Foreclosed Property

Tax Foreclosure Property Auction